23

de Febrer

de

2016

Act.

23

de Febrer

de

2016

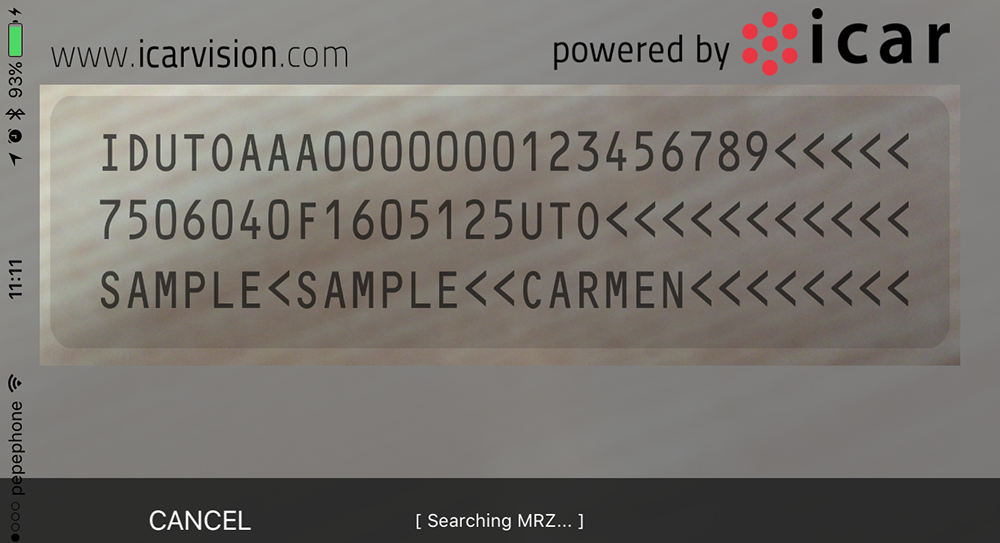

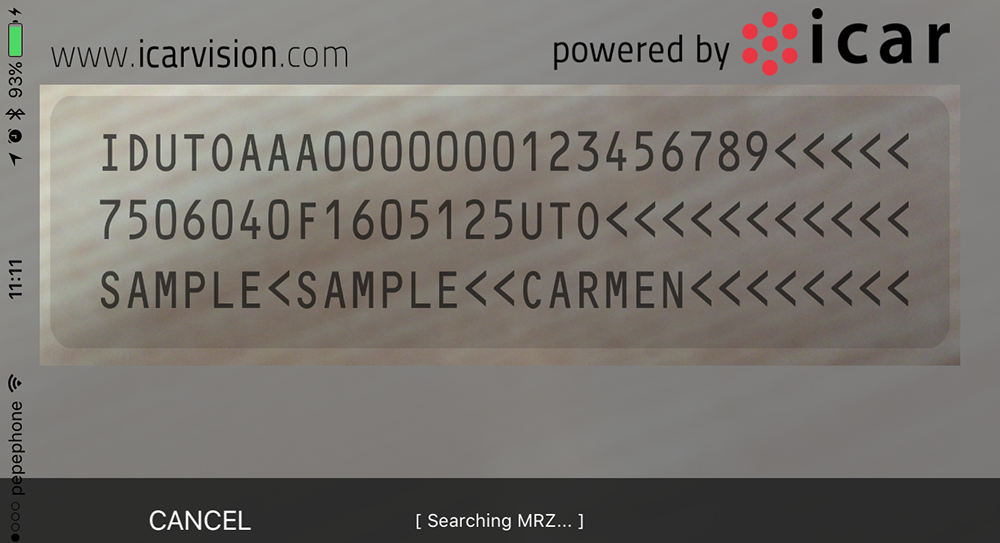

The Mobile World Congress 2016 wants to avoid queues and so has chosen a Catalan company to facilitate more efficient access for attendees. The app is ICAR, a spin-off from the Universitat Autònoma de Barcelona, which created a system for registering and verifying identities through the ID Mobile application and information storage in the cloud. The tool is integrated into the congress phone app and will help the attendees to save time queuing to register by going directly to specific control points set up for them, where that all is required is to read a QR code that ID Mobile generates after scanning the person's identity document.

The main aim is to "avoid fraud and help in the management of documentation," says the CEO, Xavier Codó. To do this, the system scans either a photograph or a document, sends the image to a cloud service and extracts the information to then place it at the disposal of clients who need to draw up contracts or verify documents, among other things.

An app designed for casinos

The project's origin is in the casino of Sant Pere de Ribes (Garraf) when, in 1998, it was preparing to move to its current incarnation as the Gran Casino de Barcelona in the Vila Olímpica. "They estimated that this change of location would bring in between 2,000 and 3,000 people a day, which meant a lot of work checking the ID numbers of each of the clients," Codó says, adding "including all of this information by hand was not feasible and so they contacted the Centre de Visió per Computador of the UAB".

There work began on a product which led to the creation of ICAR as a company in 2002. This gave the casino a tool for automatically reading and verifying IDs, although at the same time it could be adapted for other sectors.

Even though the basic product remains the same, at the beginning the spin-off used a scanner to make a visual reading of ID cards and passports, while now it does so through a smartphone app. A step forward thanks to the flexibility offered by mobile technology that came as early as 2009.

Banking and e-commerce also want security

"After the casino, the first natural sector was hostelry and access monitoring, and later we evolved to bring the app to the financial world," says the ICAR CEO. They have a portfolio of clients made up of important hotel chains like Melià, NH or Iberostar; as for banking, Codó mentions La Caixa, BBVA and Iberbanc, among others on the list.

They are currently undergoing a process of diversification and consolidation in the insurance and e-commerce sectors. Regarding the former, Codó says they have been working with some companies for two years, while in e-commerce they have just finished conducting trials.

In the world of banking, ICAR allows a user to securely open a bank account from home, ask for a loan or carry out any other procedure. If the financial institution already has the client registered, all he or she has to do is provide their personal information and a photograph. "An image is taken with the camera on the phone or computer and a short video, so that we know that the person can move and is therefore real, and not an old image," Codó points out to dispel any doubts about the system's efficiency. Then the system compares the information the client provides against that which it has in the cloud; if they match, the procedure goes ahead.

The application for online purchases differs in a few details. To begin with, the idea is to only use the technology for high-value purchases, both at the time of the transaction and when the item is delivered. In the trials done with MRW, Seur and Correos, according to Codó, "with the company PDA the deliverer can take a photo of the receiver's ID, upload it to the cloud and check that it is the right person."

Ease or security?

ICAR calculates that banks lose between 1% and 4% of revenue, a figure that can be reduced by between 80% and 99%. "Also in e-commerce, where the percentage of fraud is similar," says the CEO.

Codó believes that within two years this type of solution for verifying identities will be completely established. "It has already been implemented in banking, and now it is the turn of retail and delivery; it needs to be implemented soon, which will serve to provide a boost," he insists. However, first a significant obstacle will have to be overcome: "The dilemma between the user's experience and security."

Normally, security is associated with an infinite number of forms, robot detectors and passwords, and so it tends to simplify navigation. It is a situation that only generates complaints and that can even "affect the business". "However, if you make everything very easy, it opens too many doors and can undermine security. So, what is to be done? We will try to bring the two together," he says about the work left to do.

The MWC, international shop window

The spin-off needs no boost to make the leap, because that step has already happened, but it does need help in expanding the number of clients and increasing its international turnover, which makes up 35%, with the rest in Spain. ICAR is in 30 countries in Europe and Latin America, while their only two competitors –both North American- are focusing on the US market and those of other Anglo-Saxon countries.

Apart from offering identity verification services, they will be at the MWC with a stand and will also give a presentation of network security. All of this they hope will serve to "further raise the international profile and make it well-known around the world."

The company is based in the Parc Tecnològic del Vallès and they are in daily contact with the UAB's Centre de Visió per Computador, which they compare with Barça's Masia academy: "We were born there and it was where some of the team came from. We also have people from the centre on the board and we still do research projects with them."

For 2016 and 2017, they want to continue growing, both in terms of the number of employees and turnover, which reached 2.8 million euros in 2015 and which is estimated will go up to 5 million within the next two years.

The main aim is to "avoid fraud and help in the management of documentation," says the CEO, Xavier Codó. To do this, the system scans either a photograph or a document, sends the image to a cloud service and extracts the information to then place it at the disposal of clients who need to draw up contracts or verify documents, among other things.

An app designed for casinos

The project's origin is in the casino of Sant Pere de Ribes (Garraf) when, in 1998, it was preparing to move to its current incarnation as the Gran Casino de Barcelona in the Vila Olímpica. "They estimated that this change of location would bring in between 2,000 and 3,000 people a day, which meant a lot of work checking the ID numbers of each of the clients," Codó says, adding "including all of this information by hand was not feasible and so they contacted the Centre de Visió per Computador of the UAB".

There work began on a product which led to the creation of ICAR as a company in 2002. This gave the casino a tool for automatically reading and verifying IDs, although at the same time it could be adapted for other sectors.

Even though the basic product remains the same, at the beginning the spin-off used a scanner to make a visual reading of ID cards and passports, while now it does so through a smartphone app. A step forward thanks to the flexibility offered by mobile technology that came as early as 2009.

Banking and e-commerce also want security

"After the casino, the first natural sector was hostelry and access monitoring, and later we evolved to bring the app to the financial world," says the ICAR CEO. They have a portfolio of clients made up of important hotel chains like Melià, NH or Iberostar; as for banking, Codó mentions La Caixa, BBVA and Iberbanc, among others on the list.

They are currently undergoing a process of diversification and consolidation in the insurance and e-commerce sectors. Regarding the former, Codó says they have been working with some companies for two years, while in e-commerce they have just finished conducting trials.

In the world of banking, ICAR allows a user to securely open a bank account from home, ask for a loan or carry out any other procedure. If the financial institution already has the client registered, all he or she has to do is provide their personal information and a photograph. "An image is taken with the camera on the phone or computer and a short video, so that we know that the person can move and is therefore real, and not an old image," Codó points out to dispel any doubts about the system's efficiency. Then the system compares the information the client provides against that which it has in the cloud; if they match, the procedure goes ahead.

The application for online purchases differs in a few details. To begin with, the idea is to only use the technology for high-value purchases, both at the time of the transaction and when the item is delivered. In the trials done with MRW, Seur and Correos, according to Codó, "with the company PDA the deliverer can take a photo of the receiver's ID, upload it to the cloud and check that it is the right person."

Ease or security?

ICAR calculates that banks lose between 1% and 4% of revenue, a figure that can be reduced by between 80% and 99%. "Also in e-commerce, where the percentage of fraud is similar," says the CEO.

Codó believes that within two years this type of solution for verifying identities will be completely established. "It has already been implemented in banking, and now it is the turn of retail and delivery; it needs to be implemented soon, which will serve to provide a boost," he insists. However, first a significant obstacle will have to be overcome: "The dilemma between the user's experience and security."

Normally, security is associated with an infinite number of forms, robot detectors and passwords, and so it tends to simplify navigation. It is a situation that only generates complaints and that can even "affect the business". "However, if you make everything very easy, it opens too many doors and can undermine security. So, what is to be done? We will try to bring the two together," he says about the work left to do.

The MWC, international shop window

The spin-off needs no boost to make the leap, because that step has already happened, but it does need help in expanding the number of clients and increasing its international turnover, which makes up 35%, with the rest in Spain. ICAR is in 30 countries in Europe and Latin America, while their only two competitors –both North American- are focusing on the US market and those of other Anglo-Saxon countries.

Apart from offering identity verification services, they will be at the MWC with a stand and will also give a presentation of network security. All of this they hope will serve to "further raise the international profile and make it well-known around the world."

The company is based in the Parc Tecnològic del Vallès and they are in daily contact with the UAB's Centre de Visió per Computador, which they compare with Barça's Masia academy: "We were born there and it was where some of the team came from. We also have people from the centre on the board and we still do research projects with them."

For 2016 and 2017, they want to continue growing, both in terms of the number of employees and turnover, which reached 2.8 million euros in 2015 and which is estimated will go up to 5 million within the next two years.