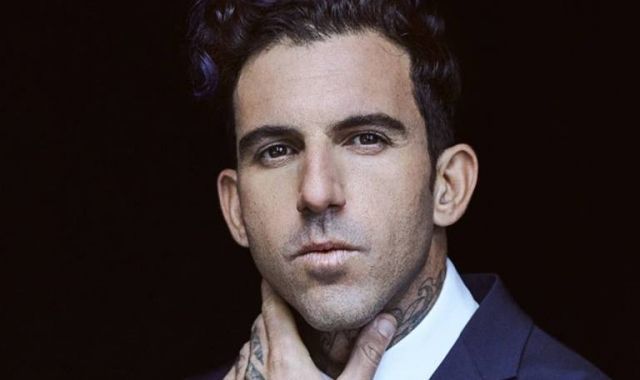

Josef Ajram is considered a fortunate person and not out of just luck. "The secret was knowing from very small what I wanted to do and what I didn't," he admits. He gave up university for the stock market, now more than 17 years ago. Ajram is a day trader, the founder of Where is The Limit? and Ajram Capital, and an ambassador for brands like Hyundai, Tag Heuer and El Row. In his spare time he never stops doing extreme triathlons. He has just published El pequeño libro de la superación personal 2 (Alienta, 2018) where in a hundred quotes (from Van Gogh to Woody Allen) he explains what goes through his head for at least 15 minutes every day. He learns from everything and everyone. Both the stock market and life is a travail, full of failures and successes.

What is trading like in the 21st century?

Trading has changed a lot due to the quantity of financial products, such as cryptocurrency. It is a world that shows you must constantly reinvent yourself and learn. The concepts we knew 15 years ago have little to do with those of today. Right now there are many products, a lot of mechanisms and, if used correctly, they can be a great opportunity, but if used without any control they can be very dangerous.

"Some 90% of the small investors operating with a CFD currency product lose 90% of the capital in the first 90 days"

Is there speculation on the stock market?

Without a shadow of a doubt. There are devastating statistics: some 90% of the small investors operating with a CFD currency product lose 90% of the capital in the first 90 days. It's brutal. Someone buys a newspaper and thinks they know the stock market. There is that about of wanting to hit the jackpot, of not understanding that they can lose, and that can destroy them.

There's a lack of education in finance...

Most people are small shareholders who go into the stock market without knowing enough about it. There's no doubt about that. When people ask me: "Where would you put these thousands of euros?" my answer is: "Into learning."

What are the most important lessons you have learnt from the stock market?

What students find the hardest to understand is that we have to be ready for and know how to lose. We must also have patience. There is a great quote by Peter Lynch, which goes: "Humans do not have the patience to get rich slowly and that's why they decide to ruin themselves quickly." It is a good summary of the world of the stock market, on the level of the small investor or business.

"Someone buys a newspaper and thinks they know the stock market"

How much can you win or lose on the stock market?

It depends on whether it is an investor or a trader, and on the capital, it is a percentual issue. You can lose everything if you do things badly and use leverage, but if you do things logically and know how to lose, losing everything is impossible. The extremes would be: you can lose it all or you can double the capital. The most logical thing is to find that point of balance and to be honest about the risk.

Have you ever lost it all?

I began, I've lost, I understood why, I've won, I've had my ass kicked and I have made big profits… All the possibilities for learning now did not exist 20 years ago. Those of us who have been doing it for a long time learnt the hard way. All the knowledge, being on the ball and the calmness I have are the result of the lessons the stock market taught me.

Give us a particular moment.

On April 23 and 24 of 2007 I got my first big blow, losing 110,000 euros that I managed to recover the next day. They were two exceptional days and it was the first time in my life that I saw that the stock market was vulnerable.

“There will always be someone- some bloody nuisance, in truth- who will criticize you," you say in the book. Is it a case of whether good or bad, it's all publicity at the end of the day?

I prefer no one to speak badly of anyone. I don't like it. I prefer everything to go along normally, without any conflict and without anyone attacking me. When media looking for clicks attack me, I wonder why... All they have to do is call and check the information. They always end up regretting it when they bring out false information because I contact the media outlet and give them the right information. The twittering media does harm.

Trader, triathlete and the face of different brands... Does it all add up?

It all adds up. Creating a personal brand helps. Years ago the media became aware of a brand that did not exist and which is like none other. That of someone dedicated to the distant world of the stock market, who does sports events that would seem difficult to most people, and who has an aesthetic not normally seen in the financial world. That makes you unique, whether for good or bad, and communication-wise it does help.

"On April 23 and 24 of 2007 I had my first big blow, losing 110,000 euros"

Is achieving happiness a goal or the path?

Happiness is a goal and an end. Being happy is a great objective and that is what we struggle for, so that you are affected by the fewest variables possible and you can be calm about it. For me, the most important thing is the family and that everything you do everyday makes sense. We sometimes forget about what is truly important.

“Rewards have to become a routine,” you add. Perhaps routine will mean we stop valuing rewards…

We should value things that are well done and be able to recognise them. Right now we are in conflict with the press, it should not bother you if a colleague of yours does well, but there are people who are bothered by this. Rewards and understanding that it's not normal for everything to work out well is also interesting for keeping the group highly motivated.

How do you maintain motivation at Ajram Capital?

I try to make sure we are all on the same page and make it clear that the key is not the sum of individualities but rather the team work and whether a colleague does well, as that benefits the group. We should not only focus on the bad things. Right now we are doing well: we had a boom year, with a lot of demand and maybe we will die of success by not knowing how to absorb it all. Right now we have three financial products, two of which work very well in terms of profitability. However, the Sicav is moving more slowly. The first year was really good, the second really bad, and now we are in the market with more than 700 clients and a very high satisfaction rate.

They say that criticism weighs four or five times more than recognition.

There is a statistic from Amstel that says that 86% of Spaniards have a good day if they feel they have done things well. Sport has shown me that doing things well is not the norm. Doing 100 kilometres on a bicycle in the desert is not normal, getting clients or writing a good article is not normal.

"We should never reach the limit itself because that would mean having no objectives and a life without goals can be dangerous"

Where is the limit?

The limit goes with the objectives. Does finding the limit mean that it's your next objective? You have to ask yourself what the objectives are that make you feel motivated, happy and that give your working and personal life sense. We should never reach the limit itself because that would mean having no objectives and a life without goals can be dangerous. My professional plans for the future are consolidating Ajram Capital and continuing to indulge my passion for sport.

What advice would you give to new entrepreneurs?

Above all that they be aware of whether they are actually entrepreneurs. It has become very socialised and perhaps not everyone is ready to be an entrepreneur. But for those who are, there are three variables to think about: to have a project with a budget within your reach (and not get carried away with large investments), not to use up capital all at once, and lastly, to control the fixed costs very strictly because it is one of the main reasons why startups fail. With a good team, you should begin from a position of humility and coworking with the smallest financial restrictions possible. Let's get rich slowly rather than ruining ourselves quickly.